starting credit score canada

Your credit history is the financial record of how you. A good FICO score lies between 670 and 739 according to the companys website.

It depends on the credit score you have a credit score of 300 to 900 might have good credit standing.

. Your credit score is a number between 300 and 900 that tells lenders in Canada how. As a resident of Canada you will automatically begin building a credit history once you start using credit in the country. FICO says scores between 580 and 669 are considered.

You can read our pick of the best newcomer bank accounts here. A good credit score is based on the three digit number you receive from TransUnion or Equifax. In order to enhance your credit score one of the simplest things you can do is to pay your bills on time.

If youve never had credit activity a credit card or loan or instance you wont start at 300. You can request your credit report and score online mail a paper application or call them at 1-800-663-9980. Both Wise and Postmedia collect a commission on sales through the links on this page.

In between 780 and 900 you should get good marks. Your credit score is a three-digit number that comes from the information in your credit report. Once you have credit the single biggest thing you can do to improve your credit score.

It shows how well you manage credit and how risky it would be for a lender. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740. A good credit score is a three digit number.

In Canada it ranges from 660-900. In Canada credit scores can be as high as 900 and as low as 300 but dont worry. In Canada credit scores range between 300 and 900 with a higher score being better.

Learn more about how your credit score is calculated. According to TransUnion credit score ranges are categorized as follows. Pay your bills on time.

Credit scores range from 300 just getting started 650 the magic middle number. A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan. Payment history accounts for about 35 of your credit score.

Your credit score from Equifax is accessible online for. Alternatively some Canadian banks provide. You can access your credit score online from Canadas 2 main credit bureaus.

What Is A Good Fico Score.

Steven Fisackerly What Is Your Credit Score Credit Score Bar Chart Sayings

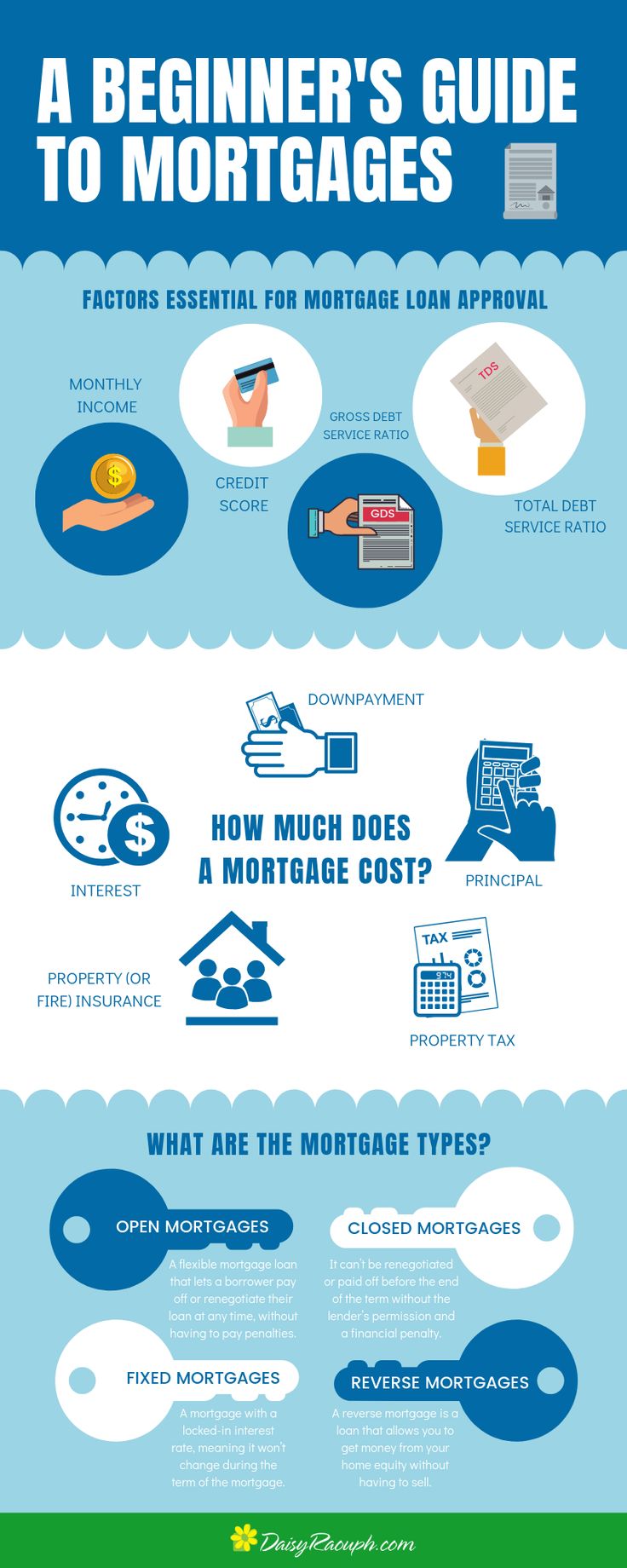

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

We Wish You All A Fabulous And Productive Week Get Started On Your Journey To Financial Stabi Improve Your Credit Score Credit Repair Credit Repair Companies

Pin En Credit Score Credit Report

6 Ways To Rebuild Your Credit After Bankruptcy Credit Info Center Blog Credit Repair Paying Off Credit Cards Rebuilding Credit

The Lifecycle Of Bankruptcy This Infographic Describes The Life Cycle Of Bankruptcy Starting At T Refinance Mortgage Credit Repair Companies Improve Credit

Canadian Mortgage Fraud Is On The Rise Never Trust All We Are Here To Provide You The Best Solution Good Credit First Time Home Buyers Mortgage

Rebuilding Credit After Bankruptcy How To Rebuild Credit Rebuilding Credit Debt Help Bankruptcy

6 Ways You Can Use Your Credit Card To Improve Your Credit Score Credit Repair Improve Your Credit Score What Is Credit Score

5 Tips For A Good Credit Score To Buy A House Good Credit Score Good Credit Credit Score

Top 10 Innovative Canadian Startups In 2021 Start Up Improve Credit Score Startup News

Why Do Credit Scores Differ Infographic Credit Score Infographic Finance Infographic Credit Score

8 Easy Ways To Increase Your Credit Score Fast In Canada In 2022 Improve Credit Score Improve Credit Paying Off Credit Cards

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Best Credit Card Rewards Programs For Beginners Credit Card Hacks Paying Off Credit Cards Best Credit Cards

10 Professional Habits You Should Have Habits Money Mindset Career Goals