gift in kind taxable or not

If the gift exceeds the exemption threshold the full value is taxable. 50000 during PY entire gift is taxable.

Tax Free Tip Cards 100 Pack Taxation Is Theft

Income Tax - From now on when you get a gift in kind valued at more than Rs.

. At the time of this articles. Gifts from one person to another arent taxed. However if the cash.

Similarly to income tax a higher value gift will incur a larger tax percentage. If any individual is in receipt of gifts in excess of Rs. 50000 from your parents or other relatives make sure you have a sworn affidavit declaring the donor your.

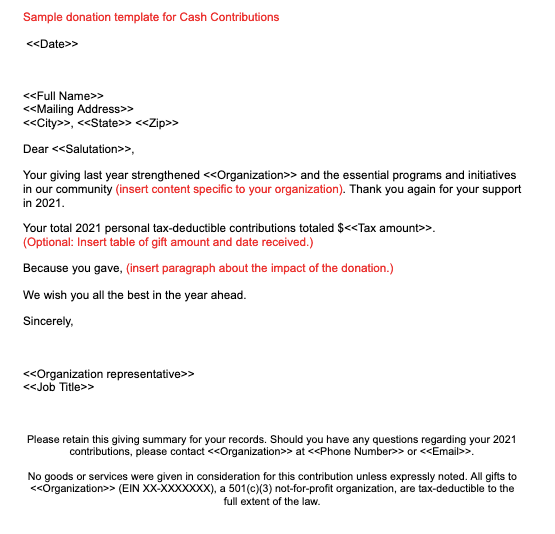

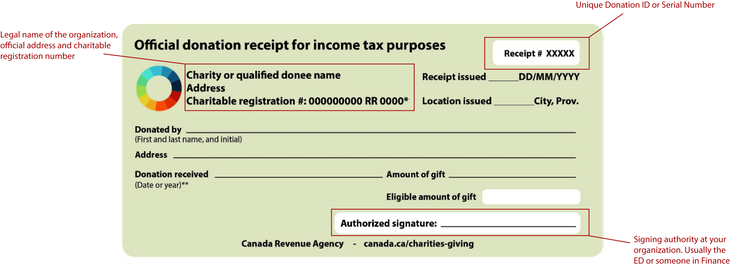

This article is for informational. Example gifts-in-kind NFP financial statement disclosures AICPA 2022 Nonprofit Audit Guide National Council of Nonprofits Disclaimer. Generally a donor may deduct an in-kind or non-cash donation as a charitable contribution.

If the aggregate value of gifts received is less than Rs. Cash gift received from person other then above. Eg If your brother gift u Rs 50 00000 than it will not be taxable in the hand of recipient you.

An employer will give an employee a John Lewisvoucher for Christmas. See also Which Type Of Violation Is One. All gifts received from relatives irrespective of value are exempted from the levy of Gift Tax.

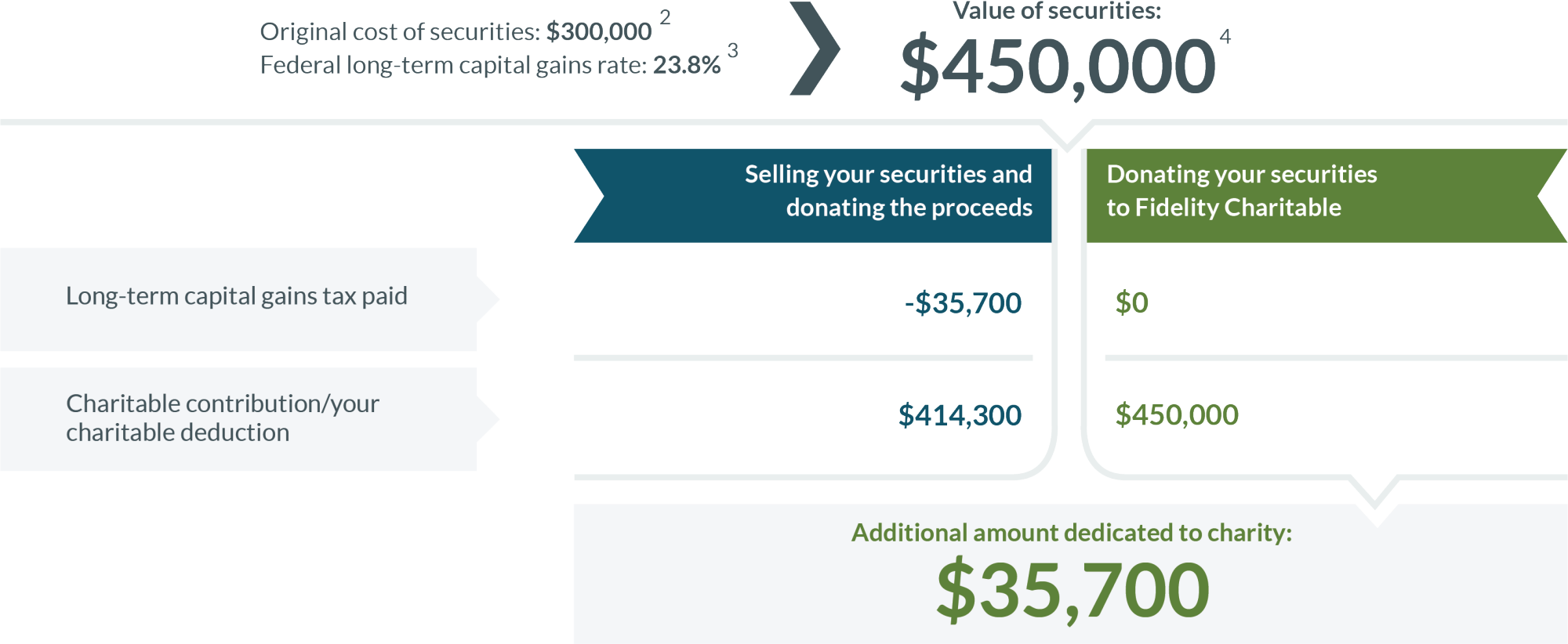

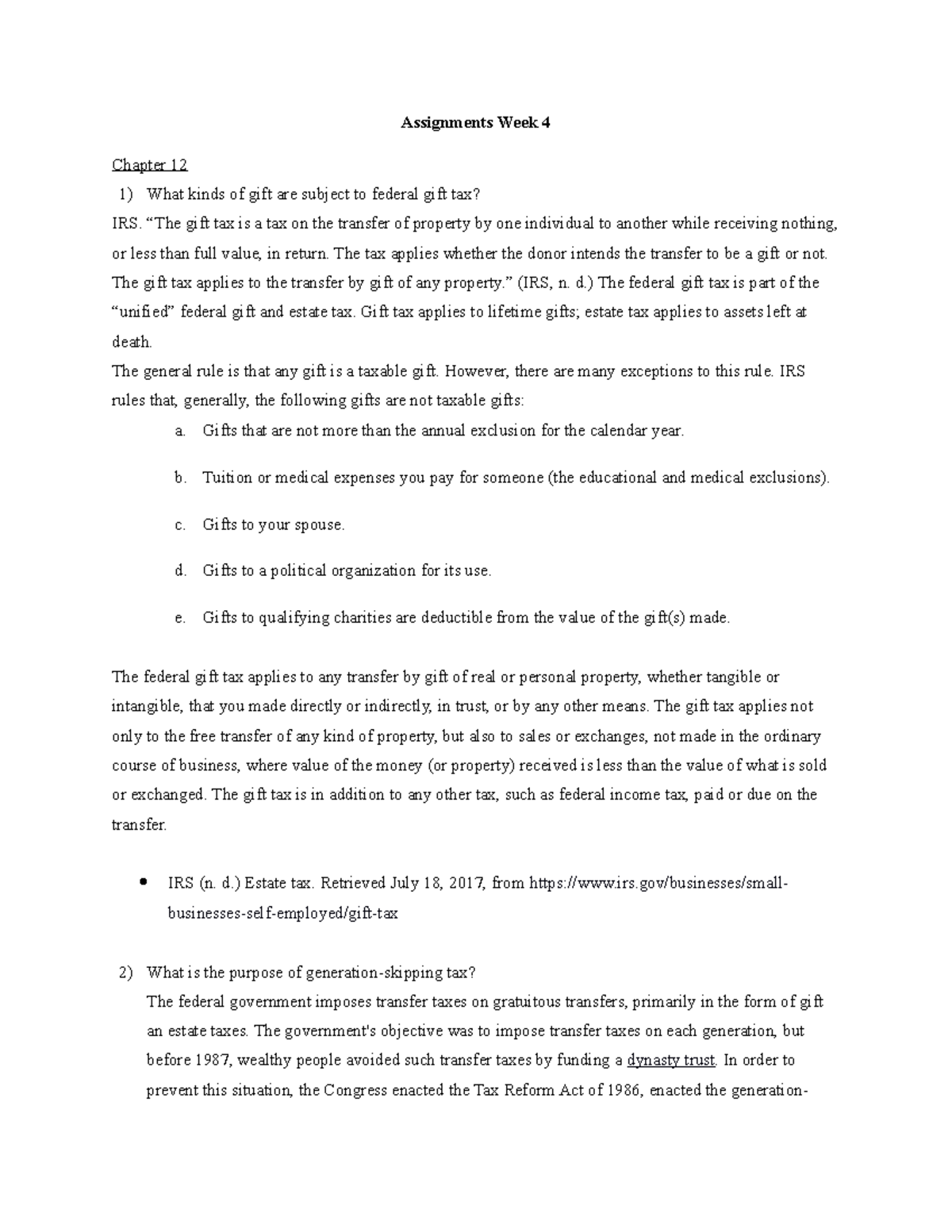

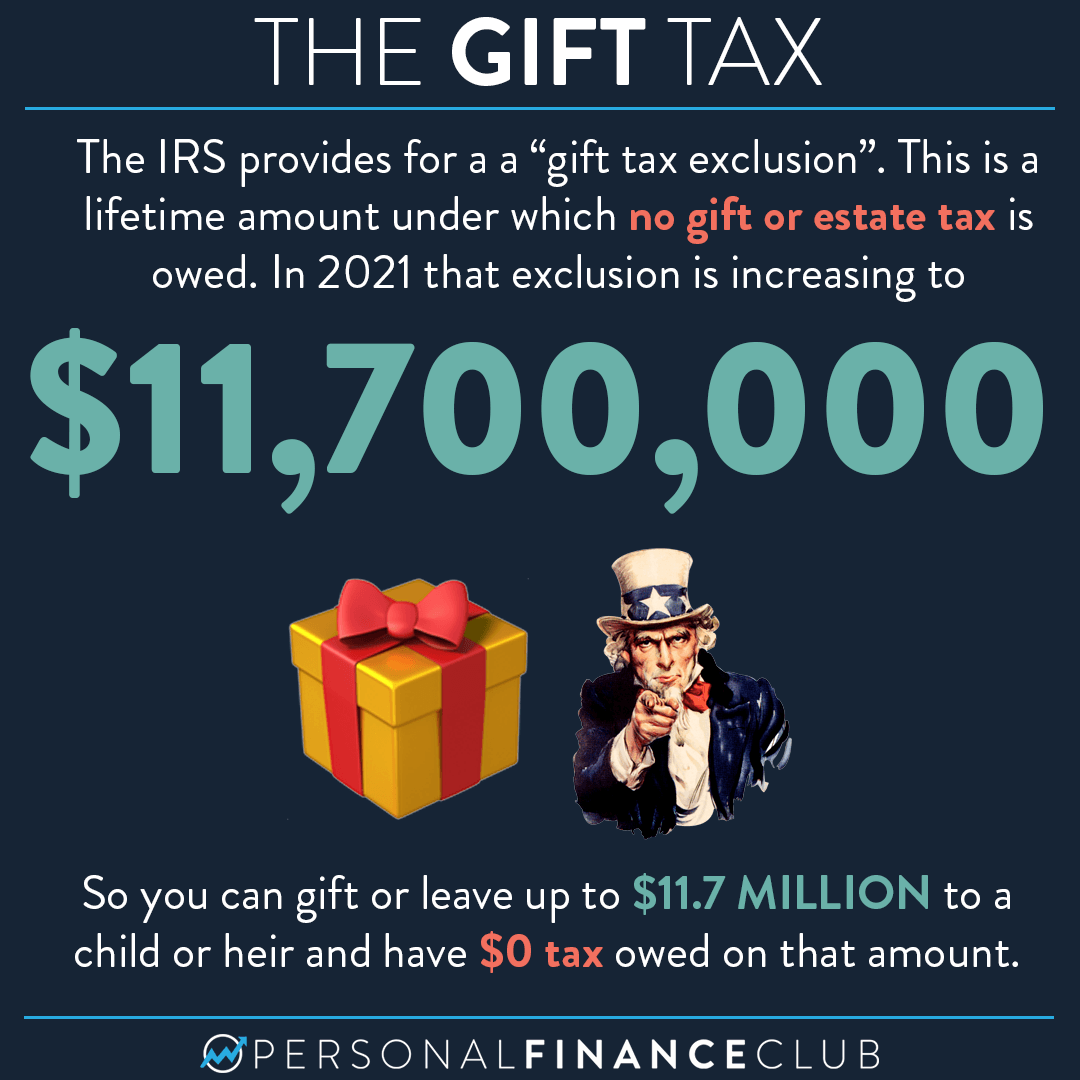

The gift tax rate is between 18 and 40 percent depending on the value of the gifts. The general rule is that any gift is a taxable gift. For example a gift of up to.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Not only are the written acknowledgment requirements complex especially. If the aggregate value of gifts.

And a donor must obtain. What type of information should be on his tax receipt. See Applying the Exemption.

Simply put it is a form of charitable giving in which a donor does not give money to buy goods and services the donee-organization needs but instead gives the goods and. The tax applies whether or not the donor. Income Tax - From now on when you get a gift in kind valued at more than Rs.

In excess of Rs. The answer depends on several factors such as how you are filing other deductions and what kinds of donations are being reported. However nothing will be charged to tax if the aggregate amount.

The normal Benefit in Kind rules will apply if the gift exceeds this value. Section 56 of the Income Tax Act 1961 prescribes a threshold limit of Rs. The giver does not have to file a gift tax for money or property given worth less than this amount and the recipient does not have to report this gift as long as the total tax year gift amount from.

50000 in aggregate in a year for taxing gifts. Immovable property taxable if. The FMV of 10000 as of the date.

As a guide a gift not exceeding 200 is considered to be not substantial in value. The list of prescribed occasion on which gift is not charged to tax and hence gift received from friends will be charged to tax. Under the gift tax exclusion gifts of up to 14000 per person are not subject to gift tax.

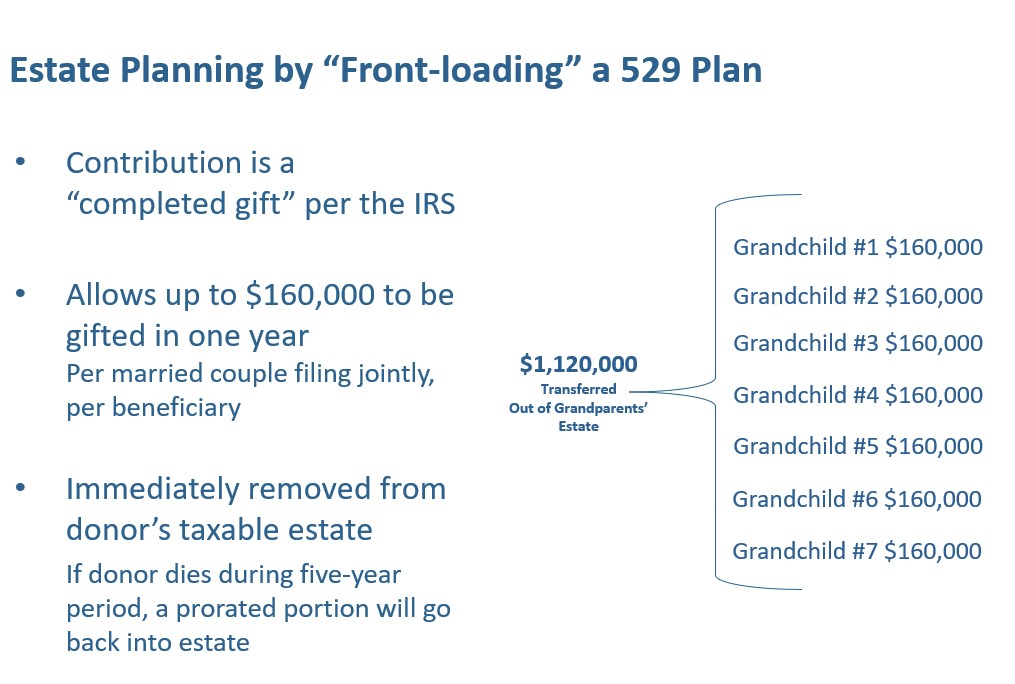

How To Gift Educational Expenses Tax Advantages And Pitfalls

Your Complete Guide To In Kind Donations

Will You Owe A Gift Tax This Year

Before Giving Diwali Gifts This Festive Season Know About Their Tax Implications Here Businesstoday

Got An Expensive Gift From Your Boyfriend Is It Taxable

Why You Should File Non Taxable Gifts With Your 2021 Taxes

Do Cash Gifts Count As Income 1040 Com Blog

Using Gift Cards As A Tax Free Trivial Benefit Blackhawk Network

Income Tax On Gifts Gift Received From Relatives Is Tax Free Mint

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Assignments Week 4 These Questions Are Covered Among Other Regarding Tax Matters What Kinds Of Studocu

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

How Does The Gift Tax Work Personal Finance Club

The Gift Tax Made Simple Turbotax Tax Tips Videos

Nonprofit Donation Receipts Everything You Need To Know

Gifts To Employees Taxable Income Or Nontaxable Gift